4kodiak/iStock Unreleased via Getty Images

4kodiak/iStock Unreleased via Getty Images

E-Commerce giant Amazon.com, Inc. (NASDAQ:AMZN) will present its earnings sheet for the third-quarter on October 27, 2022, and earnings expectations are not very high. The retailer is likely going to see continual top line pressure in its large e-Commerce business as inflation raged on throughout the third-quarter and weighed on consumer spending. While Amazon Web Services could save the day for Amazon, I believe the stock is likely going to revalue to the down-side in the near term. The risk profile for Amazon’s stock is currently not attractive and the stock is not a buy!

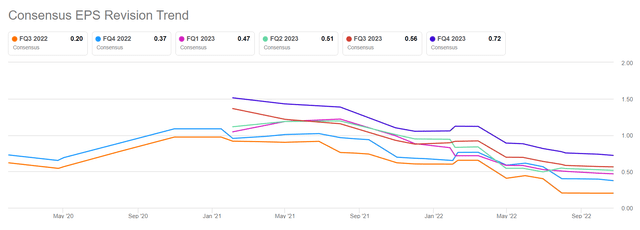

Expectations for Amazon’s third-quarter are low: analysts expect the online retailer to report just $0.20 in adjusted EPS, which implies a year-over-year growth rate of (34)%. In the last 90 days, there were 28 downward revisions for Amazon’s Q3’22 EPS and only 4 upward revisions. This tells us that the market continues to expect earnings headwinds as well as weakening key metrics for Amazon.

Seeking Alpha: Amazon EPS Estimates

Seeking Alpha: Amazon EPS Estimates

Amazon’s top line growth has slowed in the second-quarter, especially in the large e-Commerce business which accounts for approximately 84% of all net revenues. The North American e-Commerce especially is Amazon’s bread and butter… and responsible for 61% of all revenues. However, Amazon’s revenue growth has seen headwinds lately due to high inflation and slowing economic growth post-pandemic, both of which are weighing on consumer spending. For those reasons, Amazon’s top line growth slowed to just 7% to $121.2B in the second-quarter, the slowest growth rate for the e-Commerce company in two decades.

In Q2’22, Amazon’s revenue growth in North American e-Commerce slowed to just 10%, down from 22% in Q2’21, while top line growth in the International e-Commerce segment dropped 12% year over year. The only segment that has maintained its momentum in FY 2022 is Amazon Web Services… which saw 33% revenue growth to $19.7B in Q2’22. Amazon Web Services is a market leader in cloud services and had a market share of 34% in the second-quarter. AWS maintained a significant lead over the competition as well: Microsoft’s Azure had a market share of 21% and Google’s cloud platform had a market share of only 10%.

For the third-quarter, I expect Amazon Web Services to have grown its AWS revenues approximately 30% year over year. Amazon’s AWS business generated revenues of $16.1B in Q3’21, so a 30% year over year growth rate translates to approximately $20.9B in revenues in Q3’22.

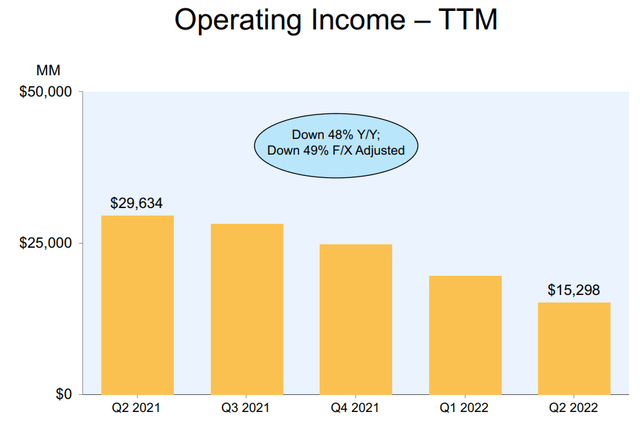

Pressure on Amazon’s operating income line is growing due to the factors mentioned earlier: inflation and a post-pandemic slowdown in economic growth. Amazon’s operating income in Q2’22 was $15.3B so the e-Commerce company remained solidly profitable, but the trend is negative as inflation and higher interest rates weigh on consumer spending. A strong USD is also a short-term challenge for Amazon.

Source: Amazon

Source: Amazon

The most interesting part of Amazon’s earnings release on judgment day will be the outlook for Q4’22. Amazon submitted a surprisingly strong outlook for Q3’22: the retailer expected revenues for the third-quarter of $125B to $130B which translates to a year over year top line growth rate of 13-17%, and it will be interesting to see if Amazon sees persistent revenue momentum for the fourth-quarter as well.

The outlook for the fourth-quarter will likely determine what will happen to Amazon’s stock in the foreseeable future: a strong outlook for Amazon’s top line growth in Q4’22, which includes the important holiday season, could push shares of Amazon into a new up-leg.

I believe Amazon will guide for revenue growth of 10-14% in the fourth-quarter since Q4 is typically a strong quarter for retailers. However, should Amazon disappoint and submit a weak outlook for Q4’22, then shares could sharply revalue lower.

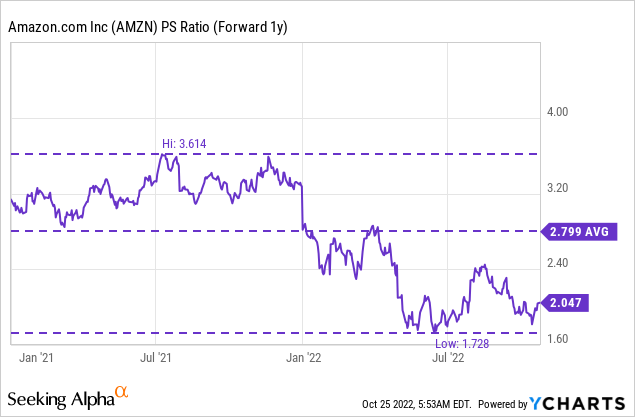

Amazon’s shares are down 28% this year, but the third-quarter earnings release could push Amazon into a new down-leg if the company spooks investors with its outlook. Amazon currently has a P-S ratio of 2.0 X which is about 43% below its 1-year high (P/S ratio of 3.6 X).

The biggest commercial risk for Amazon right now is a continual slowdown in its e-Commerce business if macroeconomic conditions continue to deteriorate. Amazon founder Jeff Bezos recently warned of a recession by saying that “the probabilities in this economy tell you batten down the hatches.”

The strong USD is also a challenge for Amazon in the short term, since USD weakness makes profits achieved abroad less “profitable” for U.S. companies. Additionally, I see risks regarding Amazon’s heavy reliance on e-Commerce. While AWS is growing quickly and likely benefited from strong customer adoption in Q3’22, the company’s general commercial and financial performance will chiefly be determined by its (weakening) e-Commerce business.

Thursday is judgment day for Amazon. Although earnings expectations are low for Amazon’s third-quarter, I believe the stock is currently not a buy and continues to have an unattractive risk profile. There are multiple headwinds for Amazon including high inflation, decelerating growth in the dominant e-Commerce business, and possibly a weaker outlook for Q4’22, which could weigh on the company’s shares after earnings!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.