Chip Somodevilla

Chip Somodevilla

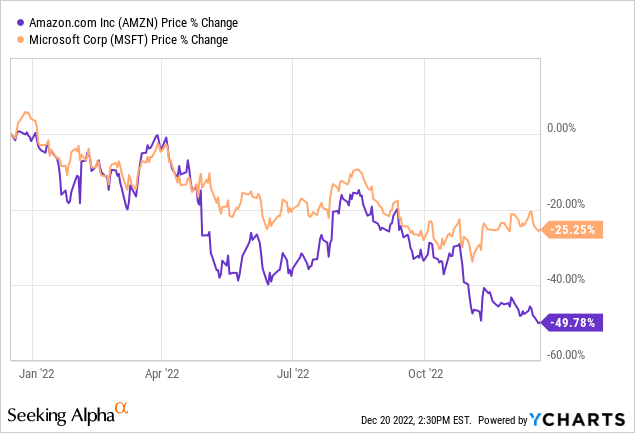

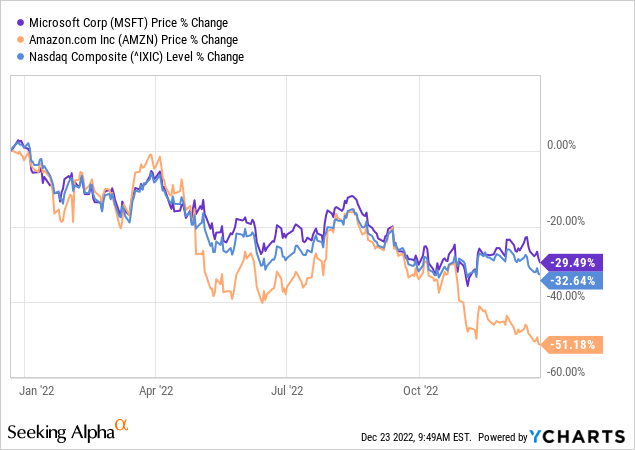

Thanks to the bear market this year, the brightest representatives of Big Tech, Amazon.com, Inc. (NASDAQ:AMZN) and Microsoft Corporation (NASDAQ:MSFT), are down 50% and 28%, respectively.

Amazon has disappointed investors with slower revenue growth amid a high base and worsening macroeconomic factors, as well as a drop in profitability, with operating income falling due to declining productivity amid aggressive growth over the past two years. At the same time, Microsoft has had a stable year so far. Although the earnings and margins have been under the pressure, the corporation has maintained stable double-digit growth across all segments and expects to do well in FY23.

As the recession steps can now be easily heard, one company is definitely positioned better than the other. And that company is Microsoft.

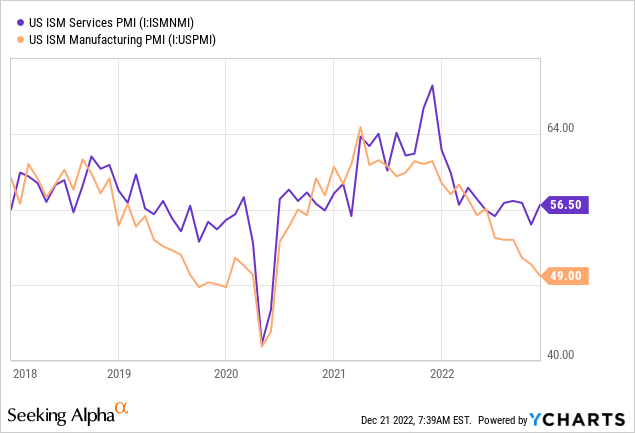

Many may mistakenly think that if inflation starts to fall, then the main risks to the economy are also reduced. Unfortunately, this is not the case (at least for now). Inflation is declining along with the cooling of the economy. Numerous leading indications of economic activity are still moving downward. Manufacturing activity is declining, everything is bleak in the service sector.

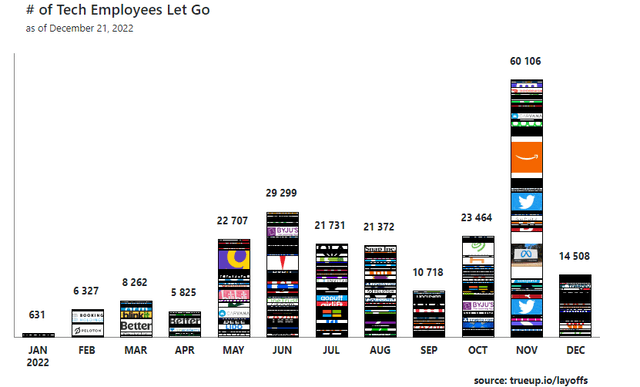

An important signal of the coming recession is mass layoffs. While the labor market remains strong, the technology sector, most sensitive to the economic slowdown, is already seeing a contraction in the workforce. According to TrueUp’s tech layoff tracker, 221,590 people have already lost their jobs this year.

trueup.io/layoffs

trueup.io/layoffs

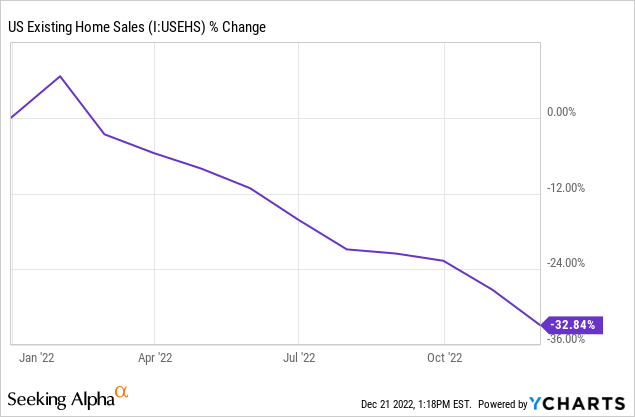

And of course, we should not forget about the already aggravated inversion between 3-month and 10-year bonds, the slowing house market, and other indicators.

Despite the enormous competition, Microsoft has continued to show incredible strength in all key segments.

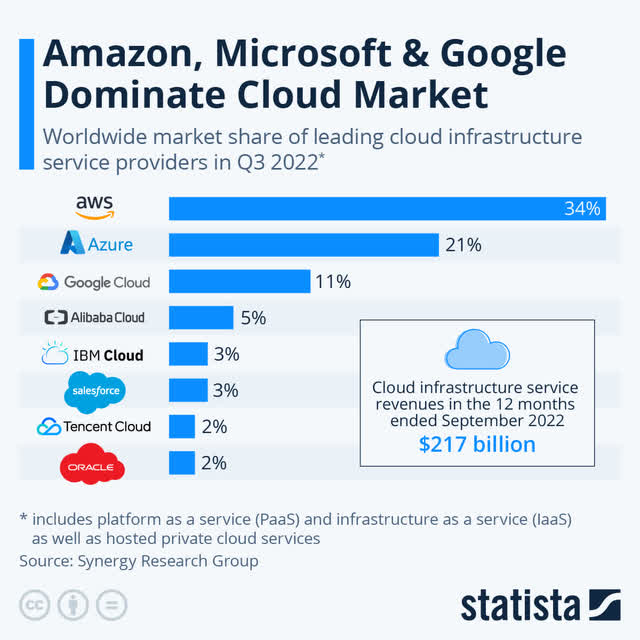

Over the past decade, IaaS and PaaS have been dominated by Amazon with its AWS cloud service. In 2018, Amazon’s market share was 47%, while Microsoft’s was 15%. Three years later, Microsoft has 24% and Amazon’s share was cut to 32%.

Statista

Statista

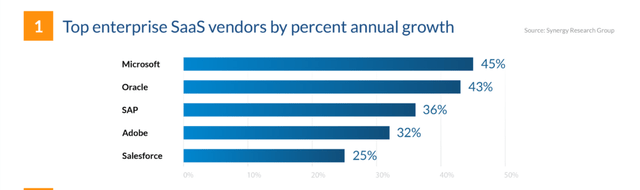

Microsoft is doing even better in the SaaS segment. The company has annually increased sales by 30-40% and in 2022 holds the status of the segment leader. It managed to get ahead of such serious competitors as IBM (IBM) and Salesforce (CRM).

financesonline.com

financesonline.com

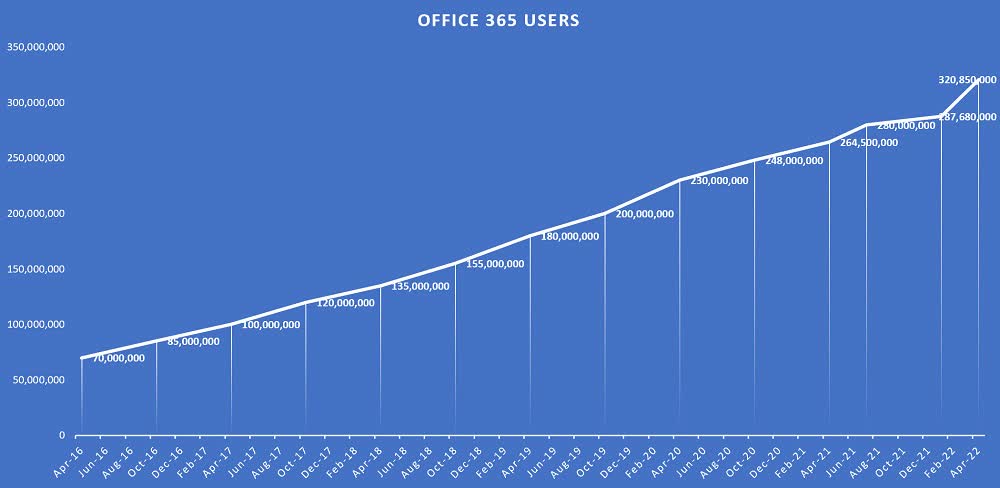

The gradual development of the online segment helps reduce dependence on Windows and Office 365.

The company continues to expand in the office suite market. The share of Microsoft Office has approached 90% and the growth will continue in the coming years. Thanks to a single ecosystem and convenient interaction through cloud services, the company’s products are popular among businesses and households.

office365itpros.com

office365itpros.com

It is also worth noting the development of the gaming segment. In the last decade, Microsoft was inferior to its main competitor Sony (SONY) due to the lack of game exclusives. That changed in 2020, when Xbox released two products at different prices, the Xbox X and S. Microsoft is now the owner of the most available gaming platform in the console market. A great addition to the segment is the recent acquisitions and developments of their gaming products. The corporation is on track to buy Activision Blizzard (ATVI) for $86 billion, which will bring needed content to Microsoft.

I usually don’t bet on conglomerates that try to expand into different areas because of their sheer size, as this almost inevitably leads to increased competition and reduced product quality. However, Microsoft is a powerful company that is gradually gaining strength through deliberate horizontal expansion. Microsoft’s position in the industry allows for double-digit growth while improving margins and product quality.

Amazon’s strength is all about e-commerce and AWS.

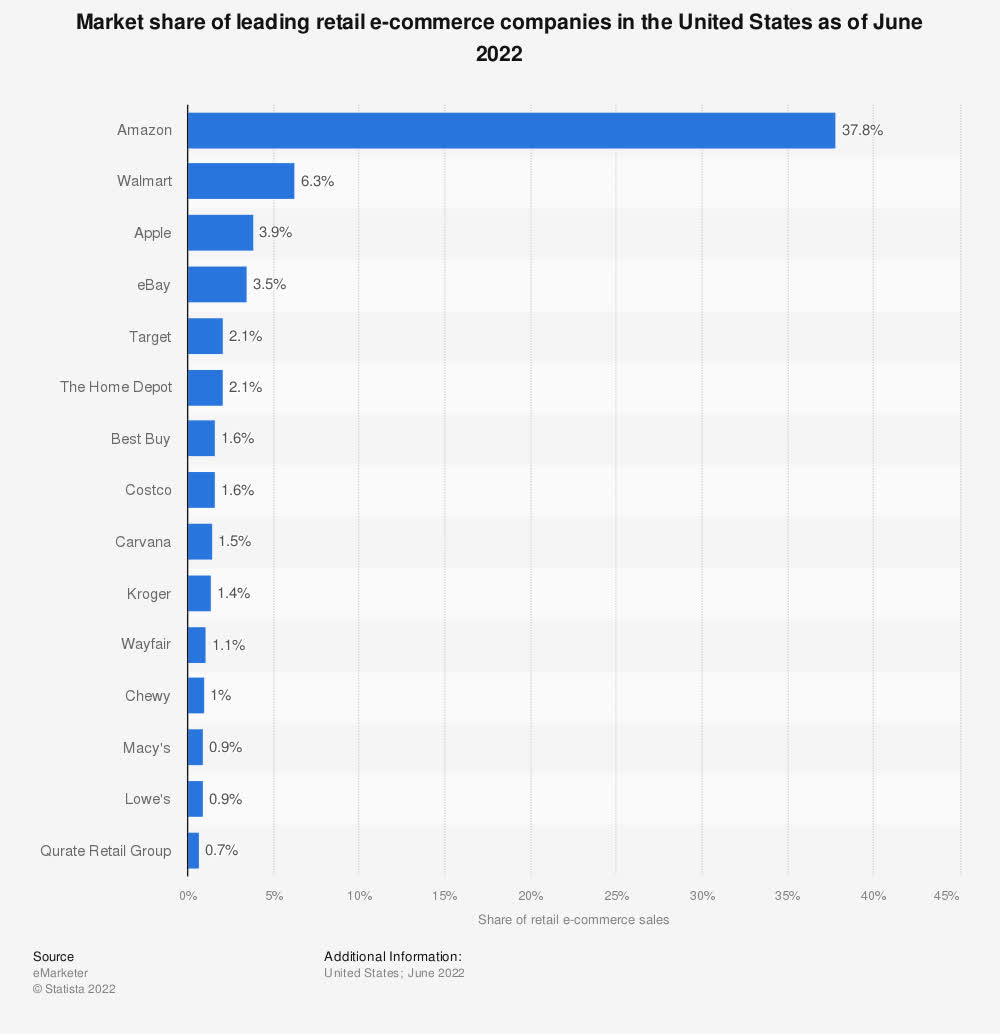

Many big players have moved online due to the pandemic. However, it is likely that Amazon will continue to increase its share in the U.S. market, gradually crowding out competitors. The company has built such a huge ecosystem that at the moment it is simply impossible to compare with anyone. Amazon.com is huge, it knows a lot about its consumers and has the best pricing and customer base. The corporation will inevitably expand in e-commerce retail.

Statista

Statista

Moving to AWS, Amazon is still the largest and undisputed leader in the IaaS market with a stunning 34% in market share. Its products are more accessible than those of Microsoft and Google when it comes to commercial services. AWS is available in more regions and zones and has significantly more services and features. However, AWS clients are mainly small enterprises that have no profit or that are just barely profitable. Enterprises usually side with Azure as Microsoft signs a record number of more than $100 million and more than $1 billion in Azure contracts. Thus, AWS is more vulnerable to the economic slowdown.

Research boutique Apps Run the World found over the summer that companies employing fewer than 100 staffers compose more than one-third of AWS’ corporate roster, compared to zero for rival Microsoft Azure

-Grant’s

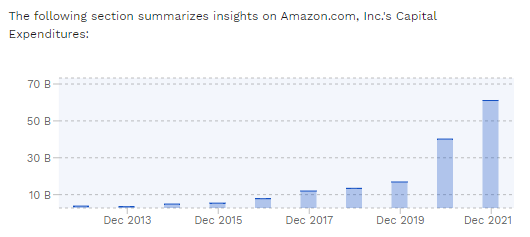

Amazon’s explosive revenue growth in 2020-2021 was driven by higher capital expenditures and an increase in headcount. СapEx increased by 3 times in 2021 as its e-commerce infrastructure peaked and was set to double in two years. This increased fixed costs and led to a deterioration in the efficiency of the e-commerce business, as investments in logistics and order fulfillment were too high.

finbox

finbox

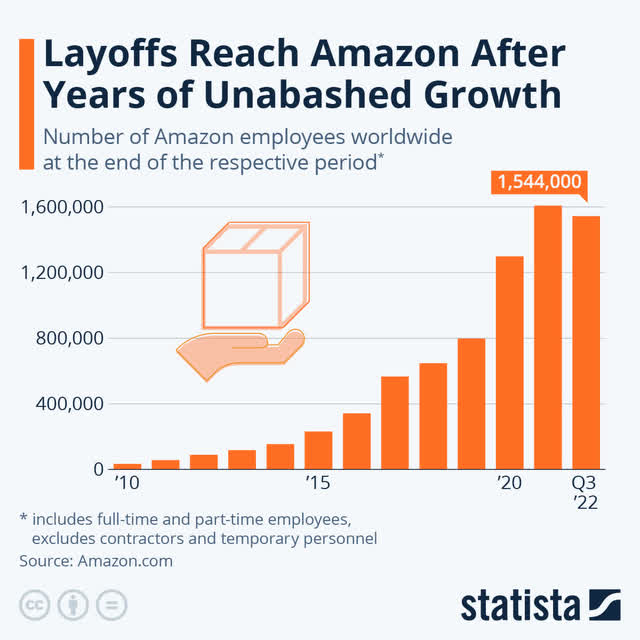

Amazon is now trying to optimize expenses. Increasing the efficiency of fixed costs and reducing the rate of hiring will help increase the profitability of e-commerce and the company as a whole. The company has already stopped hiring and even started cutting staff.

Statista

Statista

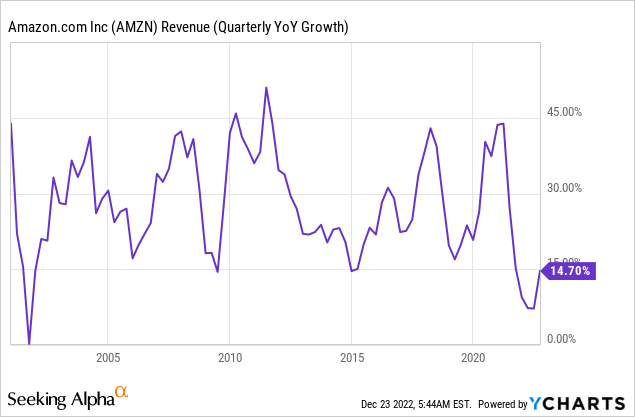

That said, Amazon is facing the slowest revenue growth in a decade.

Amazon’s long-term growth and profitability are paramount to management, meaning that quarterly results can be sacrificed to achieve long-term goals.

Heightened volatility and negative sentiment in the U.S. stock market and the technology sector, in particular, due to monetary tightening by the U.S. Federal Reserve, are forcing investors to switch companies with strong future growth to consistently profitable, high-margin companies that are less vulnerable to the economic downturn.

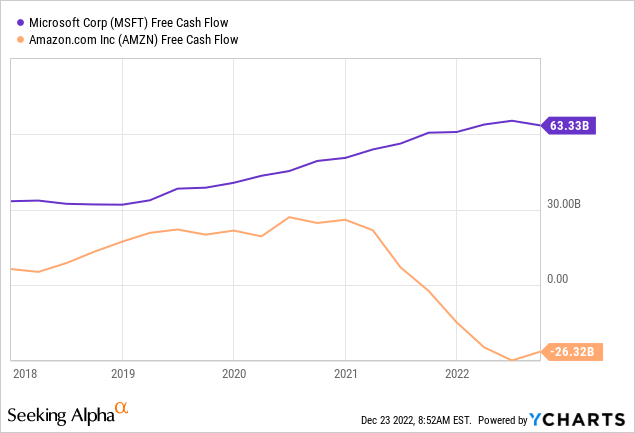

Microsoft looks like a winner in this situation as it has a massive free cash flow of $63.3 billion, while Amazon’s is well below zero. It simply means Microsoft has a gigantic amount of cash at its disposal, while Amazon doesn’t.

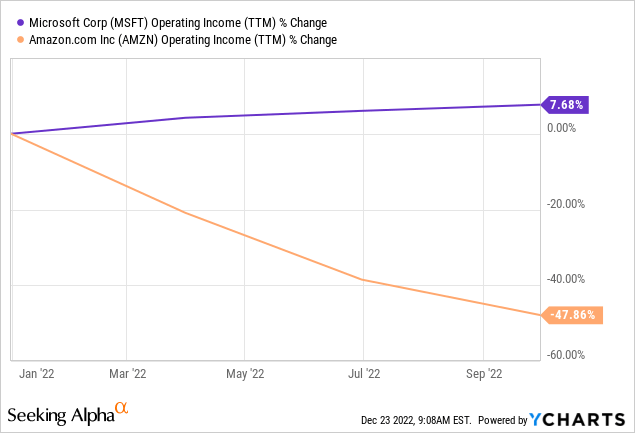

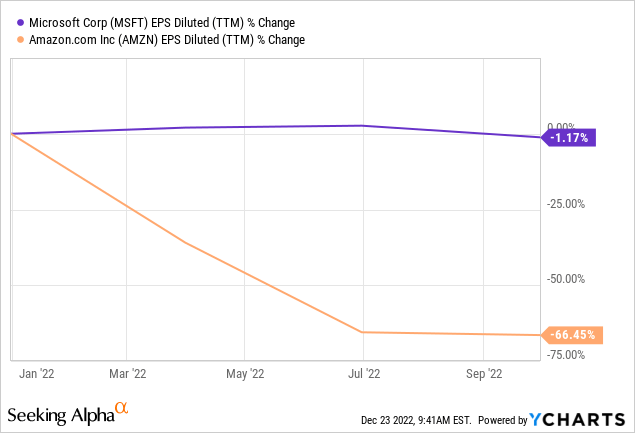

Companies’ operating income trend tells very different stories. That’s what happens when you are unable to invest as heavily as you used to and the economic environment doesn’t play in your favor.

And of course, Microsoft has not seen its EPS fall 66% this year.

Therefore, its stock has outperformed NASDAQ in 2022.

So what makes me think that Microsoft will outperform Amazon next year? A recession, which is coming in 2023, will destroy any hopes of squeezing more profits from its high-volume e-commerce business as the segment margin will decrease, which means that the company won’t be able to invest massively in the cloud, which will also struggle due to the small size of its clients.

Microsoft, on the other hand, won’t be slowed down by a mild recession as its huge horizontal business is essential for the entire IT infrastructure. The business is still in the early stages of migrating to the cloud, which means Microsoft has a strong demand for its cloud services. This is confirmed by the fact that in FY22, the order book of Microsoft corporate customers grew by 25% YoY, mainly due to the conclusion of long-term contracts for the Azure cloud platform. During the same period, the company’s obligations under the concluded contracts amounted to $189 billion. The same goes for the Dynamics 365 segment, which is necessary for the functioning of businesses around the world.

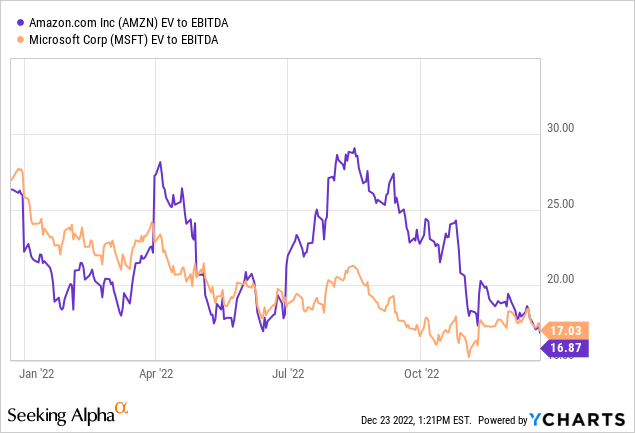

Despite dropping 50%, Amazon doesn’t appear to be cheaper on an EV/EBITDA basis. I don’t think it’s worth taking the forward multiple into account as the forecasts are yet to move downwards.

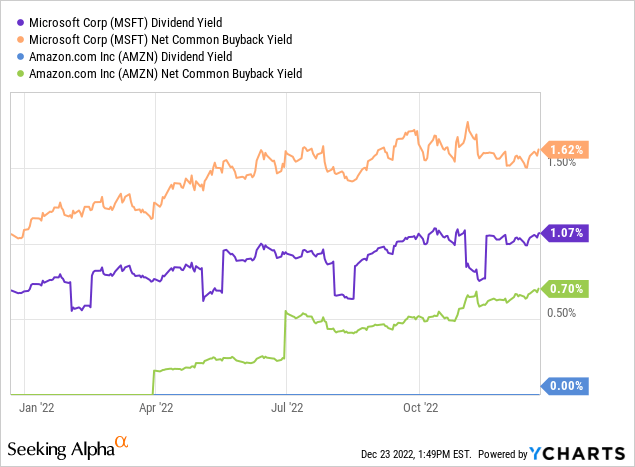

It is also worth noting that Microsoft is a great dividend company that has been increasing its payout for 17 years now. The total yield per share is 2.7%.

Amazon and Microsoft are likely to tell two different stories about the condition of the U.S. economy in 2023. Microsoft’s foundation is too strong to slow down in a mild recession. Amazon, well, has an e-commerce business. The company’s shares will inevitably bounce back massively, but it is likely to only happen in the next economic cycle.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.