Michael Vi

Michael Vi

Yes, I recently bought Amazon (NASDAQ:AMZN) shares for the first time since 2016.

Let’s cut to the chase if you don’t have time to read the entire article.

My thesis is simple: AWS alone justifies an investment today.

The stock has traded sideways for more than two years, but AWS has continued to deliver outstanding growth. As a standalone company, AWS would probably sport the same market cap as Amazon today (more on that later).

AMZN looks terrible on most screens focused on trailing financial metrics. Temporary headwinds are the main issue: Inflationary pressure, supply chain challenges, and a significant equity loss related to Rivian (RIVN).

AMZN is one of the 12 Starter Stocks in the App Economy Portfolio.

Mega caps are usually not at the top of my watch list, but the recent market sell-off has created better entry points.

Amazon fails on several of my screeners due to a relatively low gross margin and a weak balance sheet (I’m not too fond of companies with a net debt position). However, if, like me, you are a long-term investor with a time horizon beyond five years, I believe AMZN offers an attractive risk-reward today.

And it’s not just an AWS story.

Prime is getting better. Amazon has accumulated a trove of content, from live sports to high-profile shows and movies. As its exclusive content catalog expands, the subscription’s value becomes increasingly strong. Additionally, with the possibility to “buy with Prime” on other websites, the platform is expanding beyond its walled garden. Additionally, Prime’s potential is still largely untapped outside of the US.

With more members flocking to its ecosystem, Amazon is turning into an advertising powerhouse that could improve the margin profile of the non-AWS segments.

Finally, I like the recent acquisitions that could boost smart homes and healthcare initiatives. They add optionality.

While the cash flow margins have compressed in recent quarters, I believe the long-term thesis is alive and well. There’s a tremendous runway ahead and the potential for the “sum-of-the part” to unlock more shareholder value.

In summary:

Meanwhile, the concerns du jour around inflation, labor supply shortages, supply chain challenges, recession, international slowdown, and cash burn are temporary by nature. I trust management in assessing that these should be temporary issues. I expect the traits that look undesirable today to become old news as AWS, subscriptions, and advertising become a larger piece of the overall business.

I look well beyond this cycle and believe the improving margins could lead to market-thumping returns for shareholders.

Are you still here?

Let’s dive into more details.

Sometimes, a chart is worth a thousand words.

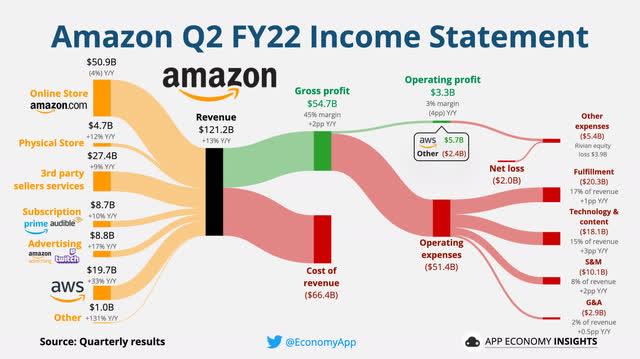

I summarized the flow of Amazon’s Q2 FY22 income statement in the diagram below.

Amazon Q2 FY22 Income Statement (App Economy Insights)

This presentation gives a bird’s-eye view of the business.

I build diagrams like this for my holdings here.

What should jump at you?

- The rapid growth of AWS (+33% Y/Y) and Advertising (+17% Y/Y).

- The improving gross margin as a result.

- The astronomical AWS operating profit ($5.7B or 29% margin).

- The size of the subscription business at $8.7B (for comparison, Apple made $19.6B from Services in the same quarter, which includes the App Store and Apple Pay).

- The one-off equity loss caused by Rivian.

Many investors don’t spend the time to break down the various parts of a business. While most people know Amazon for the top three segments, my focus is on the others for obvious reasons (growth and margin profile).

AWS means A Wonderful Segment

I’m genuinely amazed by the size and growth of AWS (Amazon Web Services).

The continued growth is impressive, given the scale of the business:

- Amazon Web Services: ~$79B run rate, growing +33% Y/Y.

- Microsoft Azure: ~$55B run rate, growing +40% Y/Y.

- Google Could: ~$25B run rate, growing +36% Y/Y.

Here is a breakdown of the cloud infrastructure market in Q2 2022.

As companies embrace digital transformation and cloud migration, AWS serves as the foundational layer of their cloud operations. The cloud infrastructure market could achieve a revenue CAGR of 12% through 2030.

AWS is a trillion-dollar business in plain sight.

Prime expands its content and reach

Additionally, Amazon still has a long runway with Prime.

They’re bolstering their content offerings with exclusive live sports (NFL games in the US, soccer games in Europe) and TV shows like The Lord of the Rings.

Amazon is focused on third-party sellers (a higher margin business) and could expand its reach with “Buy with Prime” on the open web.

The rise of an advertising giant

Let’s move on to another critical tailwind: digital advertising.

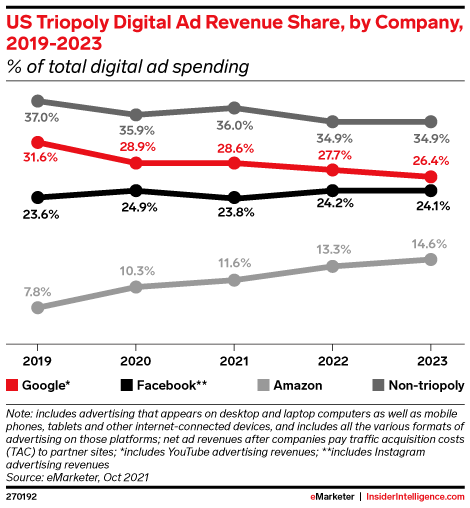

Amazon’s advertising services reached $8.7B in Q2 FY22 (+21% Y/Y fx neutral). According to eMarketer, Amazon will represent 14.6% of the US Digital Ad revenue market in 2023.

US Digital Ad Revenue Share (eMarketer)

As a leading marketplace with a massive base of 200+ million members, Amazon can monetize its traffic through third-party merchants.

Strategic M&A adds optionality

Last but not least, Amazon has recently made compelling acquisitions.

They’re relatively small, but they could lead to tremendous opportunities when leveraged with Amazon’s reach:

- One Medical (ONEM): An all-cash transaction valued at $3.9B. It’s not a good outcome for ONEM shareholders but a good one for AMZN shareholders. I’ve used One Medical in San Francisco and see the potential for a HealthCare service included with Prime for more than 200 million members. For now, it’s a boutique provider with only 47 offices, but the potential is there.

- iRobot (IRBT): An all-cash transaction valued at $1.7B. It’s also not a great outcome for IRBT shareholders, with shares close to a six-year low. Amazon likes IoT (Internet of Things) and wants to play a more prominent role in turning our homes “smart.” The Roomba is incredibly popular and joins other smart devices (Echo, Ring). Amazon has first-hand knowledge of the success of the best products in its marketplace and has been working with iRobot to make the Roomba compatible with Alexa.

AMZN Q2 FY22 Highlights

Let’s review the most recent quarter:

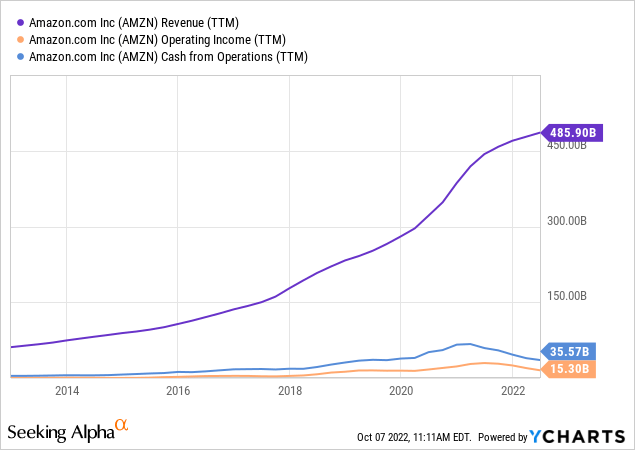

- Net sales increased +7% to $113B vs. +3%-7% guidance.

- Operating income was $3B (vs. $8B in Q2 FY21), vs. $5B consensus

- Operating cash flow decreased by (40%) to $36B for the past 12 months.

Guidance for Q3 FY22 is +13%-17% Y/Y, and operating income is $0-$3.5B.

Revenue by segment (growth fx neutral Y/Y):

- Online Store: $51B (0% Y/Y).

- Physical Store: $5B (+13% Y/Y).

- Third party sellers: $27B (+13% Y/Y).

- Subscription services: $9B (+14% Y/Y).

- Advertising services: $9B (+21% Y/Y).

- AWS: $20B (+33% Y/Y).

Amazon fell short of the consensus on the operating income, with significant losses in the non-AWS segments.

The company has a large net debt ($97B), but it’s not a big concern when we compare it to the $15B in cash generated from operations in the past year (and $46B generated in FY21).

Amazon is one of the most aggressive companies in the world, re-investing its profit into new initiatives and future growth.

While the balance sheet is weak, I expect the rise of AWS, Prime and advertising to improve the company’s margin profile over time and allow for more flexibility in all segments.

Are we paying a fair price?

If we look at the valuation today, the company is trading at about:

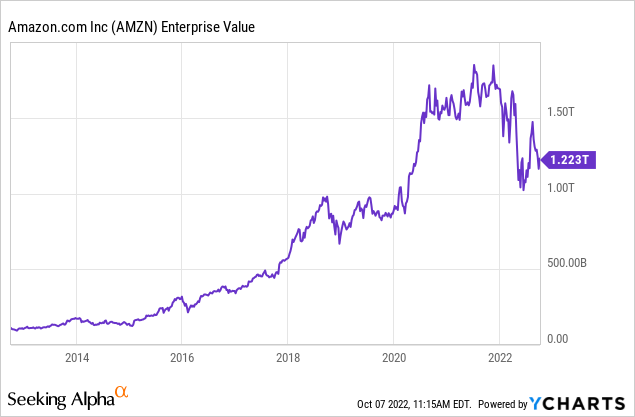

- 15 times AWS trailing revenue.

- 53 times AWS trailing operating income.

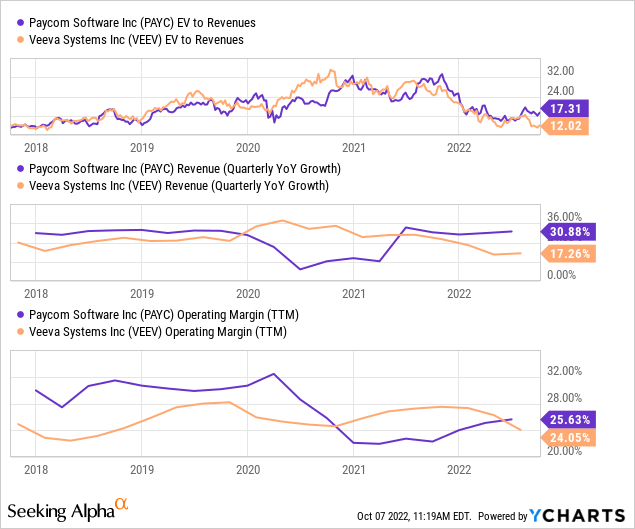

Excluding all other segments, AWS is trading at a valuation comparable to Paycom (PAYC) and Veeva (VEEV), two software businesses growing slower with lower operating margin profiles.

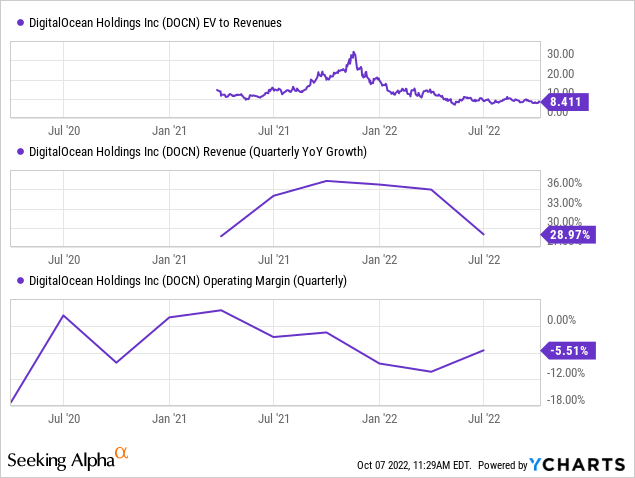

IaaS (infrastructure as a service) generally gets lower multiples than SaaS (software as a service). But note that an IaaS company like DigitalOcean (DOCN) trades at ~8 times trailing sales while growing slower and still losing money. So AWS would naturally trade at a considerable premium to DOCN as a standalone business.

Now even assuming the other Amazon segments are worth ~0.75 times trailing sales (in line with Walmart (WMT) and Target (TGT), there’s at least $300B of value out of the non-AWS segments.

But, of course, I see a lot more value in Amazon’s subscriptions and advertising segments.

With all this in mind, AMZN appears undervalued. To what extent? It primarily depends on when AWS will see normalizing growth.

With more advertising, healthcare, and IoT initiatives, I believe there’s a tremendous runway ahead and the potential for the “sum-of-the part” to unlock more shareholder value.

Any effort to build a DCF model for Amazon today would miss the forest for the trees. It would extrapolate too much from the recent temporary headwinds or overlook the potential for new initiatives to flourish.

I illustrate this idea by looking at Apple (AAPL) in 2006.

As I always say, I care more about being directionally correct.

Warren Buffett once quoted economist John Maynard Keynes:

“I would rather be vaguely right, than precisely wrong”

What about you?

Amazon Q2 FY22 Income Statement (App Economy Insights)

This presentation gives a bird’s-eye view of the business.

I build diagrams like this for my holdings here.

What should jump at you?

Many investors don’t spend the time to break down the various parts of a business. While most people know Amazon for the top three segments, my focus is on the others for obvious reasons (growth and margin profile).

I’m genuinely amazed by the size and growth of AWS (Amazon Web Services).

The continued growth is impressive, given the scale of the business:

Here is a breakdown of the cloud infrastructure market in Q2 2022.

As companies embrace digital transformation and cloud migration, AWS serves as the foundational layer of their cloud operations. The cloud infrastructure market could achieve a revenue CAGR of 12% through 2030.

AWS is a trillion-dollar business in plain sight.

Additionally, Amazon still has a long runway with Prime.

They’re bolstering their content offerings with exclusive live sports (NFL games in the US, soccer games in Europe) and TV shows like The Lord of the Rings.

Amazon is focused on third-party sellers (a higher margin business) and could expand its reach with “Buy with Prime” on the open web.

Let’s move on to another critical tailwind: digital advertising.

Amazon’s advertising services reached $8.7B in Q2 FY22 (+21% Y/Y fx neutral). According to eMarketer, Amazon will represent 14.6% of the US Digital Ad revenue market in 2023.

US Digital Ad Revenue Share (eMarketer)

As a leading marketplace with a massive base of 200+ million members, Amazon can monetize its traffic through third-party merchants.

Last but not least, Amazon has recently made compelling acquisitions.

They’re relatively small, but they could lead to tremendous opportunities when leveraged with Amazon’s reach:

Let’s review the most recent quarter:

Guidance for Q3 FY22 is +13%-17% Y/Y, and operating income is $0-$3.5B.

Revenue by segment (growth fx neutral Y/Y):

Amazon fell short of the consensus on the operating income, with significant losses in the non-AWS segments.

The company has a large net debt ($97B), but it’s not a big concern when we compare it to the $15B in cash generated from operations in the past year (and $46B generated in FY21).

Amazon is one of the most aggressive companies in the world, re-investing its profit into new initiatives and future growth.

While the balance sheet is weak, I expect the rise of AWS, Prime and advertising to improve the company’s margin profile over time and allow for more flexibility in all segments.

If we look at the valuation today, the company is trading at about:

Excluding all other segments, AWS is trading at a valuation comparable to Paycom (PAYC) and Veeva (VEEV), two software businesses growing slower with lower operating margin profiles.

IaaS (infrastructure as a service) generally gets lower multiples than SaaS (software as a service). But note that an IaaS company like DigitalOcean (DOCN) trades at ~8 times trailing sales while growing slower and still losing money. So AWS would naturally trade at a considerable premium to DOCN as a standalone business.

Now even assuming the other Amazon segments are worth ~0.75 times trailing sales (in line with Walmart (WMT) and Target (TGT), there’s at least $300B of value out of the non-AWS segments.

But, of course, I see a lot more value in Amazon’s subscriptions and advertising segments.

With all this in mind, AMZN appears undervalued. To what extent? It primarily depends on when AWS will see normalizing growth.

With more advertising, healthcare, and IoT initiatives, I believe there’s a tremendous runway ahead and the potential for the “sum-of-the part” to unlock more shareholder value.

Any effort to build a DCF model for Amazon today would miss the forest for the trees. It would extrapolate too much from the recent temporary headwinds or overlook the potential for new initiatives to flourish.

I illustrate this idea by looking at Apple (AAPL) in 2006.

As I always say, I care more about being directionally correct.

Warren Buffett once quoted economist John Maynard Keynes:

“I would rather be vaguely right, than precisely wrong”

What about you?

If you are looking for a portfolio of actionable ideas like this one, consider joining the App Economy Portfolio.

We are in a bear market, and our community is rising to the occasion.

I put my money behind my ideas and provide all-inclusive access to my portfolio and all my trades. We are in this together!

The portfolio has beaten the market since 2014.

This article was written by

Discipline and consistency win the game over time. Unfortunately, many investors violate their own model or strategy when their portfolio performance is temporarily disappointing. I would rather sell too late than too early, so I tend to never sell. I let my winners compound to a significant portion of my portfolio and let my losers become insignificant over time.

Disclaimer:

All App Economy Insights contributions to Seeking Alpha, or elsewhere on the web, are personal opinions only and do not constitute investment advice. All articles, blog posts, comments, emails, and chatroom contributions by App Economy Insights – even those including the word “recommendation” – should never be construed as official business recommendations or advice. In an effort to maintain full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The premium service App Economy Portfolio is a research and opinion subscription. I am not registered as an investment adviser. The majority of trades are reported live, but this cannot be guaranteed due to technical constraints. Investors should always do their own due diligence and fact-check all research prior to making any investment decisions. Liability of all investment decisions reside with the individual investor.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.